Finding a suitable solo 401(k) provider is pivotal for self-employed individuals seeking to secure their financial future. Solo 401(k) plans are unique retirement vehicles designed to offer the self-employed similar benefits to those available in traditional employer-sponsored 401(k)s. Choosing the right provider can be a complex process with long-term implications for your investment growth and retirement savings. In this article, we’ll delve into the factors you need to consider when selecting a solo 401(k) provider, ensuring you make an informed decision aligned with your financial goals.

Understanding Solo 401(k) Plans and Their Importance for Self-Employed Individuals

Solo 401(k) plans give self-employed professionals a powerful way to save for retirement, thanks to high contribution limits, tax advantages, and the ability to contribute as both employer and employee. This flexibility helps entrepreneurs and freelancers boost savings during strong earning years while tailoring investments across a wide range of assets. Choosing the right solo 401k providers matters, as each offers different investment options, support levels, and plan features.

Because these plans must meet IRS rules, working with a knowledgeable provider is essential. Strong guidance helps ensure compliance, prevents penalties, and keeps the plan in good standing, making a well-chosen provider a key part of long-term retirement success.

Evaluating Solo 401(k) Providers: Key Factors to Consider

When comparing solo 401(k) providers, focus on fee transparency and investment flexibility. High or hidden costs undermine long-term returns, so choose a provider with clear pricing and no surprise charges. Equally important is access to diverse investment options that match your risk tolerance, whether you prefer broad market funds, ETFs, or the ability to invest in assets like real estate or precious metals.

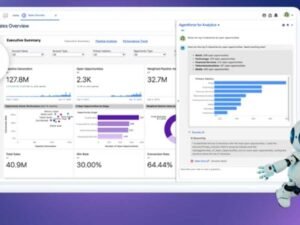

A provider’s reputation and platform quality also shape your experience. Favor companies with strong financial stability, reliable client feedback, and a long track record in retirement services. An intuitive dashboard, responsive support, and efficient tools for monitoring contributions and adjusting your portfolio make managing a solo 401(k) far easier.

Comparing Traditional vs. Roth Solo 401(k) Options

Choosing between a traditional and Roth solo 401(k) can shape both your current tax picture and long-term retirement strategy. A traditional account allows pre-tax contributions that reduce taxable income now, with taxes deferred until retirement. This option suits high-earners who want immediate relief and expect to be in a lower tax bracket later, though required minimum distributions must be factored into future planning.

A Roth solo 401(k) uses after-tax dollars, offering no upfront deduction but providing tax-free withdrawals on both contributions and investment gains when qualifications are met. It appeals to those anticipating higher future tax rates or wanting predictable, tax-free income in retirement. Many providers offer both options, allowing contributions to be split based on individual planning needs.

Navigating Fees and Investment Choices with Solo 401(k) Providers

Fees significantly influence the long-term growth of a solo 401(k), so comparing administrative costs, fund expense ratios, and transaction fees is essential. Lower fees help protect returns, but they shouldn’t replace strong service or access to quality investments. A provider with transparent pricing and dependable support can make managing your plan far easier than choosing the cheapest option with limited guidance.

Investment flexibility also matters. A broad lineup of mutual funds, stocks, and alternative assets allows you to diversify and match your portfolio to your risk tolerance. Some providers offer real estate, commodities, or private equity options, but these come with added complexity, making the provider’s expertise and support especially important.

Assessing Customer Support and User Experience for Long-Term Success

Strong customer support and a smooth digital experience shape how confidently you manage a solo 401(k). Providers with informed representatives and reliable phone, email, or chat support make it easier to resolve issues and navigate investment decisions. A clear, secure online portal with intuitive tools—such as calculators, educational guides, and performance dashboards—helps you track your account and act quickly when adjustments are needed.

Mobile access adds important flexibility, especially for entrepreneurs who manage finances on tight schedules. A well-designed app allows you to review performance, place trades, or update contributions from anywhere. Providers that invest in ongoing client education through webinars and workshops strengthen your long-term decision-making and deepen your comfort with managing retirement savings.

Overall, the best solo 401(k) provider for you offers a balance of reasonable fees, a wide array of investment options, and excellent customer support tailored to your needs. As you embark on your journey to retirement, carefully evaluating these criteria will help ensure you partner with a provider capable of supporting your financial aspirations. Remember, your choice of a solo 401(k) provider can be just as important as the investments you choose.