A steady path to stock knowledge supports smart choices, protects savings, and builds calm habits that last across changing seasons. An organized study plan reduces confusion and shows how money grows, why risks exist, and how patience improves results over time. Simple steps organize research, record progress, and keep focus on facts that matter most. Good habits around costs, safety, and steady practice turn a complex subject into daily actions that feel clear and repeatable, even when headlines feel loud.

Foundations and Basic Structure

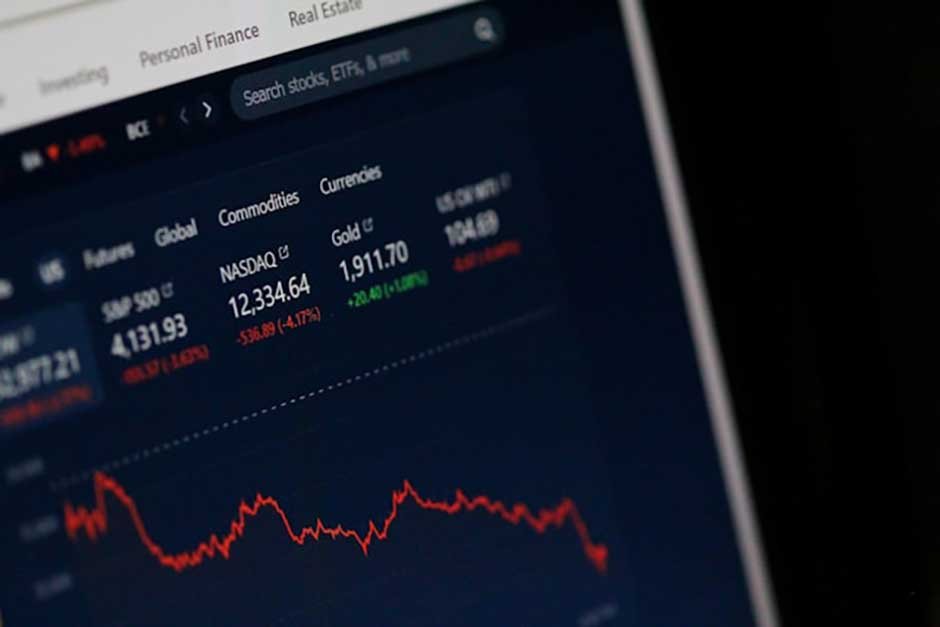

The stock market operates as a public place where companies raise funds and investors buy small ownership units through approved channels. Prices change when demand and supply shift, which means value can move during a day and across months without warning. Public rules, audits, and regular reports support fair play and keep information visible to anyone who studies calmly. Clear exchanges, settlement systems, and oversight keep trades orderly and transparent. Strong foundations start with clear terms, plain math, and safe account setups that protect identity and funds from simple mistakes. Small steps build confidence by linking goals, time frames, and comfort with movement in prices. Regular reading of trusted summaries strengthens understanding without overload and keeps attention on real drivers of change. Tidy notes on drivers, growth, and costs keep the picture complete and practical for daily study. Consistent language across notes avoids confusion and speeds later reviews.

Goals, Budget, and Time Horizon

Clear goals give direction, since short-term needs and long-term plans require different pacing and comfort with movement. A simple budget sets how much money to set aside after covering bills, debt, and a basic cushion for surprises. A written plan maps deposits, review dates, and rules for adding or pausing contributions during busy months. Simple checklists keep planning steps visible and reduce missed details. Time horizon matters because longer periods can smooth short bumps and reward patient habits that stay consistent. Records that track deposits, fees, and results show what works and what needs review without guesswork. Calm rules set limits on concentration and keep choices sized to match comfort and resources at every stage. Automatic actions like scheduled deposits and calendar reviews support discipline and keep the plan on course. Defined review windows prevent constant tinkering and support calm decision-making.

Risk, Costs, and Protection

Risk describes how much prices can swing, and protection starts with limits that keep any single decision from controlling results. Spreading exposure across many areas reduces large shocks from one name and steadies the overall path. Low, transparent costs help more growth stay in the account and support long-term goals without waste. Clear limits protect capital and keep emotions from steering outcomes. Protection also includes safe custody, two-factor security, and careful review of statements that arrive each month. Clear records of transactions, confirmations, and tax forms prevent confusion later and support clean reports. Calm posture during sharp moves protects the plan from panic and keeps focus on the time horizon and rules. Verifying account alerts improves response time and reduces small problems.

Learning, Practice, and Skill Growth

Learning works best through small daily blocks that cover price history, company updates, and plain summaries of events. Practice includes reviewing decisions, noting reasons, and measuring results against written goals that match comfort. Steady routines produce cleaner judgment and faster recognition of reliable signals that align with the plan. Short reflections after sessions turn experience into useful adjustments. Several paths offer structured practice with oversight and clear rules that reward discipline. Reputable prop firms provide guided environments with risk controls, training materials, and evaluations that support growth. Such programs demand rules-based actions, strict limits, and careful documentation, which helps beginners develop process and focus. A balanced study that compares different views and methods reduces blind spots that cause avoidable errors. Progress follows rules that focus on process rather than quick wins.

Discipline, Reviews, and Long-Term Habits

Routines are equally important in all seasons because discipline keeps plans operating during calm and busy weeks. Regular reviews check choices, fees, and alignment with goals, then adjust small parts without chasing noise. Clear calendars prompt tax tasks, record updates, and annual resets that close loops and prevent backlog. A clean dashboard shows trends without clutter or distractions. As no strategy wins every month, long-term habits include patience, curiosity, and respect for limitations. Measured steps protect energy and leave space for life outside markets while progress continues at a steady pace. Simple rules around sleep, exercise, and breaks support calm thinking and reduce errors from fatigue. Respect for limits builds confidence and keeps attention on controllable actions.

Conclusion

A beginner builds strong market skills through clear goals, steady learning, and safe habits that protect savings from avoidable loss. A simple plan for budget, risk, and time horizon reduces stress and keeps action focused on facts that matter most. Careful records, calm reviews, and honest notes guide gradual improvement and preserve energy across busy seasons. Trusted platforms, balanced study, and measured steps support growth without rushing, while patient routines turn small gains into durable progress. Consistent application of rules builds skill, steadies results.