Buying a house is one of those big life moments you never forget. It’s equal parts thrilling and terrifying. A mix of spreadsheets, open houses, and the hope that the next front door you walk through could finally be yours. But with the right mindset and plan, you can move from uncertainty to ownership with confidence.

Assess Your Finances Before Starting the Search

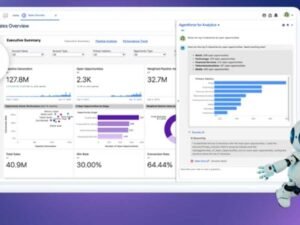

Most people start house-hunting the wrong way – they jump straight to scrolling listings. But the smartest move is to begin with a clear financial picture, not a dream house. Go over your finances first: your income, debts, savings, and how much you can comfortably spend each month.

A strong budget gives you boundaries, and boundaries give you peace. Knowing your limits from the start means you’ll walk into viewings knowing what’s possible and avoid falling in love with something you can’t afford.

Build a Reliable Support Team of Property Professionals

Buying a home is a team effort and having the right professionals on your side makes everything smoother. A good real estate agent, mortgage broker, and conveyancer is your safety net. They’ll spot red flags you might miss, keep the process on track, and save you hours of confusion.

For instance, if you’re looking for houses for sale in Lockyer Valley, a local agent will know which areas hold value and which sellers are open to negotiation. They can tell you where the best schools are, how the transport is working, and how many stores are in the vicinity of the house. Investing in the right help early on can prevent heartache (and costly mistakes) later.

Get Pre-Approved for a Mortgage

Once your financial groundwork is clear, it’s time to secure mortgage pre-approval before viewing any homes. This step establishes your budget and demonstrates to sellers that you’re a qualified buyer. A pre-approval letter from your lender outlines the loan amount you qualify for based on your income, credit score, and existing obligations.

With that confirmation in place, you can focus only on properties within your means and move decisively when the right one appears. It also gives you an edge during negotiations since sellers tend to prioritize buyers who have financing ready.

Make an Offer and Negotiate Wisely

When you find a property that fits your budget and checklist, the next step is to present a well-informed offer. Your agent can assist by reviewing comparable sales in the area and advising on a competitive yet sensible starting point. Be prepared for some negotiation. Flexibility on settlement dates or inclusions (like appliances) can often strengthen your offer without increasing the price.

If the seller counters, stay patient and measured and review your limits before responding. It’s easy to get caught in the excitement, but maintaining perspective ensures you don’t overspend or agree to unfavorable terms. A calm, data-driven approach to negotiation helps you secure a fair deal.

Complete Inspections and Legal Checks

Once your offer is accepted, the focus shifts to due diligence. This is where thorough inspections and legal reviews protect you from unpleasant surprises later. Arrange for a certified building and pest inspector to assess the property’s condition, like structural stability, wiring, plumbing, and potential infestations.

Simultaneously, your conveyancer or solicitor will conduct title searches and ensure there are no hidden encumbrances or legal restrictions. Addressing any concerns at this stage can save significant costs in the future. It’s a step many buyers rush through, but taking it seriously turns a good purchase into a secure one.

Finalize the Sale

With financing approved and inspections cleared, it’s time to finalize contracts and prepare for settlement. Your conveyancer will coordinate document exchange, fund transfers, and registration of ownership. Once the paperwork is complete, you’ll receive your keys and can officially take possession of the property.

Before moving in, arrange home insurance, connect utilities, and update your address details with essential services. Keep all legal and financial documents organized for future reference. Completing the process methodically ensures a smooth transition from buyer to homeowner without last-minute stress.

All in All

Buying a house doesn’t have to be overwhelming when each stage is approached systematically. From securing mortgage pre-approval to finalizing legal checks, confidence grows with knowledge and preparation. Surround yourself with capable professionals, rely on verified information, and make each decision deliberately. The result isn’t just owning a property, it’s gaining the assurance that you made one of life’s biggest investments wisely.